All Categories

Featured

Table of Contents

Removing representative payment on indexed annuities enables substantially greater detailed and actual cap rates (though still considerably less than the cap rates for IUL plans), and no doubt a no-commission IUL policy would certainly push illustrated and actual cap prices higher as well. As an aside, it is still possible to have an agreement that is extremely rich in agent payment have high early money surrender worths.

I will certainly concede that it goes to the very least in theory POSSIBLE that there is an IUL policy available issued 15 or 20 years ago that has actually delivered returns that transcend to WL or UL returns (extra on this listed below), but it is necessary to much better understand what a proper comparison would certainly involve.

These plans typically have one bar that can be set at the company's discretion annually either there is a cap price that defines the optimum crediting price because specific year or there is an involvement rate that defines what percent of any type of favorable gain in the index will certainly be passed along to the policy because particular year.

And while I generally concur with that characterization based on the auto mechanics of the policy, where I take concern with IUL advocates is when they define IUL as having remarkable returns to WL - indexed life insurance pros cons. Numerous IUL supporters take it an action even more and indicate "historic" information that appears to sustain their insurance claims

There are IUL policies in presence that lug even more danger, and based on risk/reward concepts, those policies ought to have higher anticipated and actual returns. (Whether they in fact do is an issue for severe argument but firms are utilizing this strategy to help warrant greater detailed returns.) For instance, some IUL policies "double down" on the hedging method and evaluate an added fee on the policy yearly; this charge is after that made use of to boost the options budget plan; and after that in a year when there is a favorable market return, the returns are amplified.

Maximum Funded Insurance

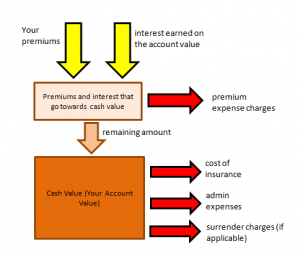

Consider this: It is possible (and as a matter of fact likely) for an IUL plan that averages a credited price of say 6% over its first ten years to still have a total adverse price of return during that time as a result of high fees. Many times, I find that agents or customers that boast regarding the efficiency of their IUL plans are confusing the attributed price of return with a return that effectively mirrors all of the policy bills.

Next we have Manny's concern. He claims, "My close friend has actually been pushing me to get index life insurance policy and to join her business. It looks like an Online marketing.

Insurance policy salespersons are not poor people. I utilized to sell insurance at the beginning of my occupation. When they sell a premium, it's not uncommon for the insurance policy business to pay them 50%, 80%, also often as high as 100% of your first-year costs.

It's hard to sell since you obtained ta always be seeking the next sale and going to locate the following person. And specifically if you don't really feel really convicted regarding things that you're doing. Hey, this is why this is the finest option for you. It's mosting likely to be tough to find a whole lot of gratification because.

Let's speak regarding equity index annuities. These points are prominent whenever the markets are in a volatile period. Here's the catch on these points. There's, first, they can regulate your habits. You'll have abandonment durations, commonly seven, ten years, perhaps even beyond that. If you can't get access to your cash, I understand they'll tell you you can take a tiny percentage.

Iul Life Insurance Policy

Their abandonment periods are huge. So, that's how they recognize they can take your money and go completely invested, and it will certainly be all right because you can't obtain back to your cash until, once you enjoy seven, 10 years in the future. That's a long-term. Regardless of what volatility is taking place, they're probably going to be fine from an efficiency point ofview.

There is no one-size-fits-all when it revives insurance. Obtaining your life insurance policy strategy best thinks about a number of variables. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your hectic life, economic freedom can appear like an impossible objective. And retirement might not be top of mind, because it seems so far away.

Fewer companies are supplying conventional pension plans and several firms have actually decreased or terminated their retirement strategies and your capacity to depend only on social security is in inquiry. Even if advantages haven't been reduced by the time you retire, social safety and security alone was never intended to be adequate to pay for the way of living you want and are entitled to.

Iul Life Insurance Calculator

/ wp-end-tag > As part of a sound financial strategy, an indexed universal life insurance plan can assist

you take on whatever the future brings. Before dedicating to indexed global life insurance policy, below are some pros and cons to consider. If you select an excellent indexed global life insurance coverage strategy, you may see your cash money value grow in worth.

If you can access it beforehand, it may be advantageous to factor it right into your. Given that indexed universal life insurance policy needs a certain level of risk, insurance provider have a tendency to keep 6. This sort of plan likewise uses. It is still assured, and you can adjust the face amount and riders over time7.

Usually, the insurance policy company has a vested rate of interest in doing much better than the index11. These are all aspects to be considered when picking the finest kind of life insurance policy for you.

Nonetheless, since this kind of policy is much more complicated and has an investment element, it can usually include greater premiums than other policies like entire life or term life insurance policy. If you don't think indexed universal life insurance policy is right for you, below are some choices to take into consideration: Term life insurance coverage is a short-lived policy that normally supplies coverage for 10 to 30 years.

Index Universal Life Insurance Companies

When making a decision whether indexed universal life insurance policy is best for you, it is very important to consider all your choices. Whole life insurance coverage may be a better choice if you are trying to find even more security and consistency. On the various other hand, term life insurance policy may be a better fit if you just require protection for a certain amount of time. Indexed universal life insurance policy is a kind of policy that supplies extra control and adaptability, in addition to higher money worth development capacity. While we do not provide indexed global life insurance policy, we can provide you with even more info concerning whole and term life insurance coverage policies. We recommend exploring all your alternatives and talking with an Aflac representative to find the finest fit for you and your family.

The rest is included to the cash money worth of the policy after charges are subtracted. While IUL insurance coverage may prove useful to some, it's crucial to comprehend exactly how it works prior to acquiring a policy.

Latest Posts

Guaranteed Universal Life Insurance Quotes

Iul Unleashed

Universal Life No Lapse Guarantee